Medium-Term Management Plan(FY2023-FY2025)

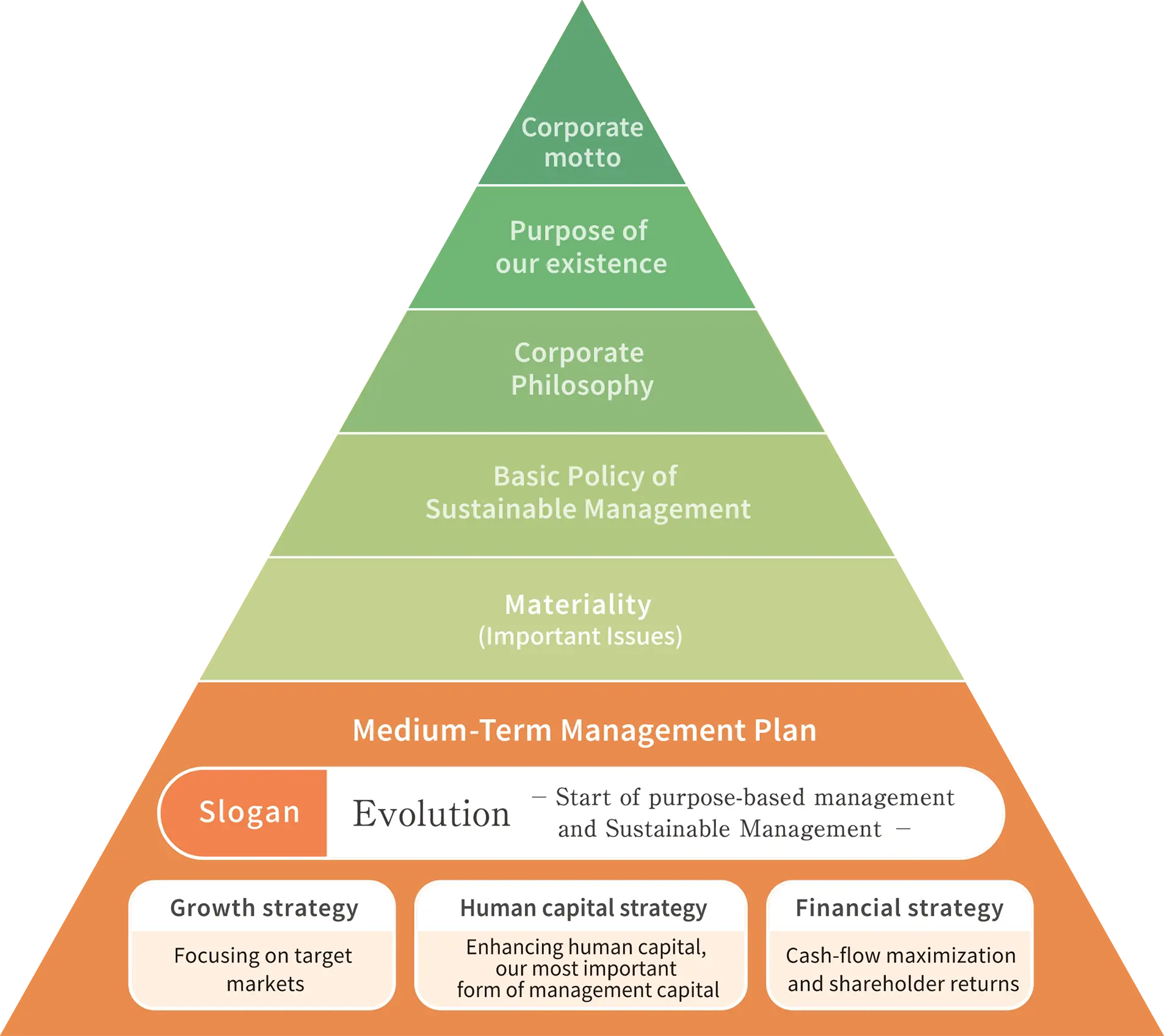

Positioning of the Medium-Term Management Plan

The Pack Group will implement sustainable management based on our Purpose (fundamental mission) and Basic Policy of Sustainable Management and has set numerical targets to be achieved by the fiscal year ending December 31, 2025.The three key strategies are linked to our response to materiality, and we will deliver the Group’s unique value to society through sustainable growth.

Numerical target

We will develop our business activities in line with our three strategies, with the goal of achieving consolidated sales of 107 billion yen. We will also strive to improve our return on equity (ROE) and return on invested capital (ROIC) in order to maintain stable relations with the Group’s stakeholders, including business partners, shareholders and employees.

| Consolidated sales | Operating income | ROE | ROIC | |

|---|---|---|---|---|

| Target of Fiscal Year 2025 | 107 billion yen | 8.3 billion yen | 8 % or more | 8 % or more |

Background of upward revisions and policy changes

In addition to pursuing companywide efforts to achieve the Medium-Term Management Plan, whose first year was FY2023, we have continued to engage in dialogue with the capital market, including investors and shareholders. Additionally, we pursue ongoing deliberations on corporate value enhancements, capital costs, and related topics at meetings of the Board of Directors and on other occasions.

Since business results in FY2023 exceeded initial targets, the Group has revised upward the medium-term management plan’s numerical targets and modified its policy on shareholder returns, aiming to increase corporate value even further.

Details of the changes

| initial plan | Revised plans | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Last fiscal year | ending December 31, 2025. | No change | ||||||||||||

| Consolidated sales | 107.0billion yen | No change | ||||||||||||

| Operating income | 7.0 billion yen | 8.3billion yen | ||||||||||||

| Dividend payout ratio | Maintaining a level of 30% or higher | Maintaining a level of 35% or higher | ||||||||||||

| Acquisition of treasury shares |

Flexible share buybacks | FY2024-2025: Acquisition of up to 1.0 billion yen in treasury shares each year |

||||||||||||

| Total shareholder returns and total payout ratio | 4.0 billion yen | 8.0 billion yen

|

| FY2022 results | FY2025 target | YOY change | YOY change | |

|---|---|---|---|---|

| Food products (*) | 250 | 320 | +70 | 28.0% |

| e-commerce, mail order, logistics | 140 | 180 | +40 | 28.6% |

| General distribution, retail, etc. | 500 | 570 | +70 | 14.0% |

| Total | 890 | 1,070 | +180 | 20.2% |

| FY2022 results | FY2025 target | |

|---|---|---|

| ROE | 6.4% | 8 % or more |

| ROIC | 6.4% | 8 % or more |

| FY2022 results | FY2025 target | YOY change | YOY change | |

|---|---|---|---|---|

| Paper bags | 262 | 315 | +53 | 20.2% |

| Paper cartons | 222 | 270 | +48 | 21.6% |

| Corrugated boxes | 122 | 150 | +28 | 23.0% |

| Film packaging | 119 | 145 | +26 | 21.8% |

| Other | 162 | 190 | +28 | 17.3% |

| Total | 890 | 1,070 | +180 | 20.2% |

* The food products category includes packages for food products at convenience stores, supermarkets, etc

Important strategies

Growth strategy

Focusing on target markets

We are selecting and prioritizing target markets to re ect contemporary trends. In the food products market, including fast food and convenience stores, we are expanding use of our products by testing to control quality risks, responding to demand for larger lot sizes and delivery use, and proposing simpli cation of packing and storage on the work oor and in stores. In the e-commerce, mail order market, and logistics industry, we are proposing overall packing line improvements to enhance productivity in customer work sites. We are growing sales by leveraging our strengths as a total packaging solutions provider, through means including integrated proposals of automatic packaging systems to save labor in addition to more e cient packages.

Main initiatives

Food products market (including convenience stores and fast food)

Increase sales of primary food containers.

Develop materials and processes that help reduce environmental impact; increase sales of FSC® products (FSC® C020517).

Combined sales of paper bags and paper cartons with labels, films (film packaging), etc.

Promote solution proposals that contribute to labor savings, streamlining, and automation at customers.

Expand lineup of paper carton products.

Initiatives for trays and molded containers, etc.

E-commerce, mail order market, logistics industry

Strengthen sales of delivery bags that increase transport efficiency for customers.

Strengthen proposal-based sales that can help reduce labor requirements at customer facilities.

Proposals for product designs that reduce work hours Proposals for solutions for automating work processeDevelop materials and processes for automatic packaging and increase related sales.

Further increase sales of reinforced corrugated boxes for heavy objects.

General distribution and retail market, other markets

Increase paper bag share and continue pursuing proposal-based sales to promote paper migration.

Along with product sales, combined sales with assembly and setup work.

Develop sales channels in ASEAN region.

Product sales aligned with the 3 Rs (reduce, reuse, recycle)

Increase sales of eco paper, upcycled materials, and FSC® paper. Increase sales of eco bags and mono-material products. Develop original paper and films with 100% recycled materials.

Promote social contributions with customers.

Apply a portion of sales proceeds from eco-friendly products to promote forest conservation via The Pack Forest Environment Fund and an NPO

Human capital strategy

Enhancing human capital, our most important form of management capital

While securing and training a diverse workforce, we are improving working environments. In addition, we strive to secure human resources to support growth and maximize their value by increasing employee engagement.

Main initiatives

Securing diverse human resources

Strengthen mid-career hiring.

Promote active participation of women (full-time employee and manager ratios).

Expand employment of people with disabilities.

Develop human resources

Enhance training programs.

Support for self-initiated skill improvement and retraining.

Optimize personnel assignments

Make effective use of the talent management system.

Expand hiring opportunities (referrals, re-hires).

Develop optimal working

environments

Diverse work formats and program enhancements.

Well-being (promote health and productivity management).

Maximize employee engagement

Appropriate wage structure, enhancements to benefits.

Raise management participation awareness by joining stock ownership association.

Energize employee interactions and communications.

Conduct engagement surveys.

Enhancing human capital, our most important form of management capital

| FY2022 result | 1,797 ※Including full-time employees, contract employees, and part-time employees |

|---|---|

| FY2025 plan | 1,920 (+123 ) |

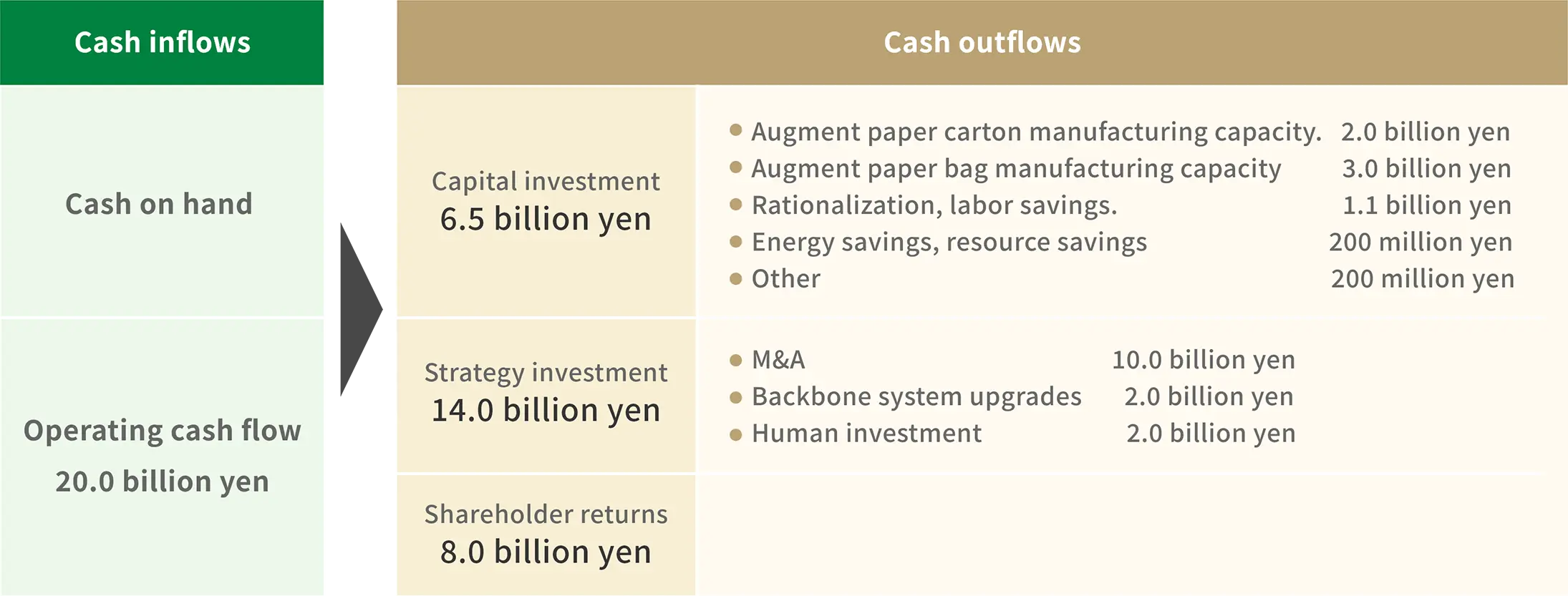

Financial strategy

Supporting efficient, continuous growth through optimal fund usage planning

We are promoting aggressive capital investment targeting growth and increased corporate value. In the area of returns to shareholders, we are aiming for a total payout ratio of 50% (announced February 2024).

| Investing in growth |

|

|---|---|

|

shareholder returns |

|

Fund usage plan (FY2023 – FY2025 total)